🔥𝐂𝐨𝐧𝐭𝐫𝐨𝐥 𝐨𝐟 𝐘𝐨𝐮𝐫 𝐏𝐮𝐫𝐜𝐡𝐚𝐬𝐢𝐧𝐠 𝐏𝐫𝐨𝐜𝐞𝐬𝐬 𝐛𝐲 𝐕𝐚𝐥𝐢𝐝𝐚𝐭𝐢𝐧𝐠 𝐓𝐨𝐭𝐚𝐥 𝐏𝐮𝐫𝐜𝐡𝐚𝐬𝐞 𝐀𝐦𝐨𝐮𝐧𝐭𝐬 𝐁𝐞𝐟𝐨𝐫𝐞 𝐏𝐨𝐬𝐭𝐢𝐧𝐠

- akash shukla

- Sep 25, 2025

- 1 min read

Inaccurate purchase invoices or credit memos can lead to compliance issues, incorrect financial reporting, and wasted time during reconciliation. With the 2025 𝐖𝐚𝐯𝐞 1 𝐮𝐩𝐝𝐚𝐭𝐞, Microsoft has introduced a 𝐠𝐥𝐨𝐛𝐚𝐥 𝐟𝐞𝐚𝐭𝐮𝐫𝐞 in D365 Business Central that ensures 𝐝𝐨𝐜𝐮𝐦𝐞𝐧𝐭 𝐭𝐨𝐭𝐚𝐥𝐬 𝐦𝐚𝐭𝐜𝐡 𝐥𝐢𝐧𝐞 𝐭𝐨𝐭𝐚𝐥𝐬 𝐛𝐞𝐟𝐨𝐫𝐞 𝐩𝐨𝐬𝐭𝐢𝐧𝐠.

𝘛𝘩𝘪𝘴 𝘧𝘶𝘯𝘤𝘵𝘪𝘰𝘯𝘢𝘭𝘪𝘵𝘺 𝘸𝘢𝘴 𝘱𝘳𝘦𝘷𝘪𝘰𝘶𝘴𝘭𝘺 𝘭𝘪𝘮𝘪𝘵𝘦𝘥 𝘵𝘰 𝘵𝘩𝘦 𝘋𝘶𝘵𝘤𝘩 𝘷𝘦𝘳𝘴𝘪𝘰𝘯 𝘣𝘶𝘵 𝘪𝘴 𝘯𝘰𝘸 𝘢𝘷𝘢𝘪𝘭𝘢𝘣𝘭𝘦 𝘸𝘰𝘳𝘭𝘥𝘸𝘪𝘥𝘦.

What Does This Feature Do?

Before posting a purchase invoice or credit memo, Business Central now validates the following:

Document Amount Including Tax matches the sum of purchase lines.

Document TAX Amount aligns with the calculated VAT on the lines.

This check helps prevent discrepancies between header totals and line totals, ensuring accuracy and compliance.

Setup Guide

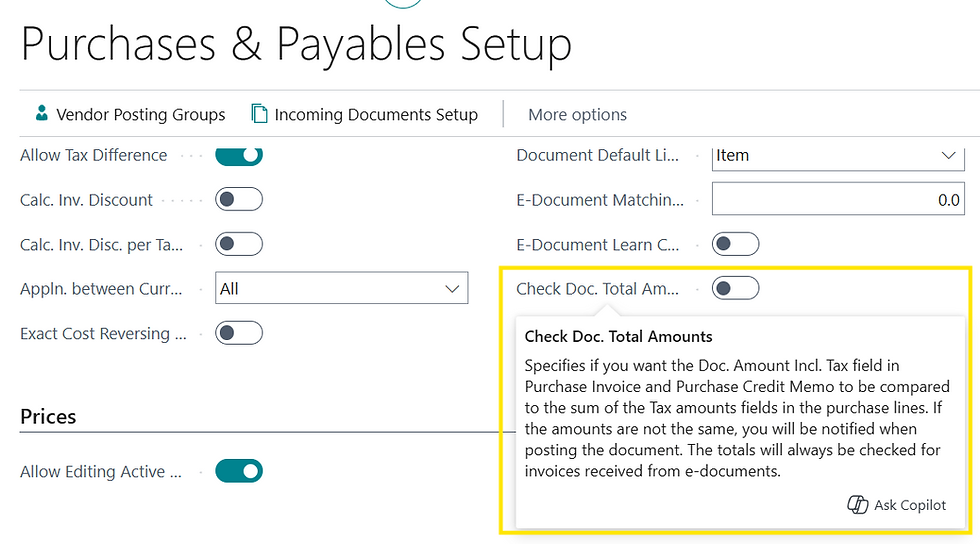

Navigate to Purchases & Payables Setup.

Enable this Boolean:

Check Doc. Total Amounts

How it Works

Two Mandatory Fields will display on Purchase Invoice and Credit Memo page in the header:

Doc. Amount Incl. Tax (VAT)

Doc. Amount Tax (VAT)

When creating a Purchase Invoice or Credit Memo, users must enter the total invoice amount and then automatically total tax amount calculated, as these fields are mandatory. If these values are not provided, the system will display an error. Additionally, if the line amounts do not match the header amounts, the document cannot be posted and will through an error.

Comments