How to create a GL account in Business Central

- akash shukla

- Feb 10, 2023

- 2 min read

Updated: Feb 20, 2023

Agenda

The purpose of writing this blog is to understand how to create masters (e.g., Customer, Vendor, Item, GL Accounts and Bank accounts) manually inside the business central/NAV. As you all aware that there are several fields available when you open any master card, and all fields are not important and mandatory to fill. So, which one is mandatory we are going to see that.

Demonstration

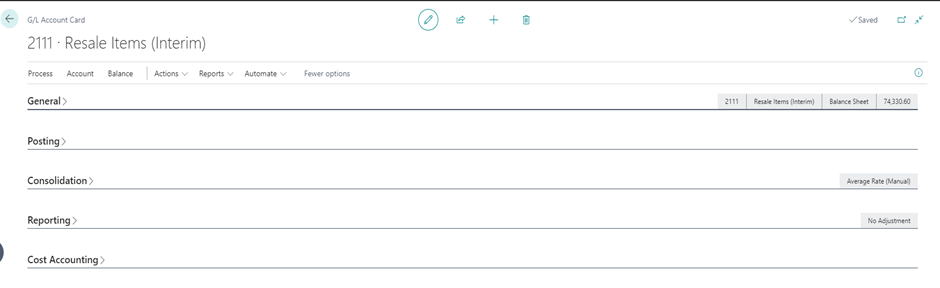

GL Account Card: -

What is G/L Account (Chart of Accounts) – A general ledger account is an account or record used to sort, store, and summarize a company's transactions. These accounts are arranged in the general ledger (and in the chart of accounts) with the balance sheet accounts appearing first followed by the income statement accounts.

Examples of General Ledger Accounts:

Some of the more common balance sheet accounts and how they are further arranged in the general ledger include:

Asset accounts such as Cash, Accounts Receivable, Inventory, Investments, Land, and Equipment

Liability accounts including Notes Payable, Accounts Payable, Accrued Expenses Payable, and Customer Deposits

How to create GL Account card in Business Central – Go to the Chart of Accounts List page and then hit “NEW” button for new item creation:

When you hit new button then GL Account card page will open. Same as others masters GL account is also a combination of Fast Tab.

In the General fast tab, below is the important fields which need to be filled and mandatory at the time of creation:

No. – GL Account No. automatically populated from No. series setup if you set this as default or user can fill this manually at the time of creation.

Name – Fill the GL account name.

Income/Balance – Select if the GL account is related to Income statement or Balance sheet.

Account Category – Select the account category, i.e. – Assets, Liabilities, Equity, Cost of goods sold.

Account Type – Select the account type, i.e. – Heading, Begin Total, End Total, Posting.

In the Posing fast tab, below is the important fields which need to be filled and mandatory at the time of creation:

GST Group Code – For Indian localization User select the GST group code, when you select this then at the time of creating purchase and sales document this will come automatically. (Below all three fields available only for Indian localization)

GST Credit – Business needs to decide the if GST credit avail for this service or not.

HSN/SAC Code – User select the related to HSN code for the item and SAC code for the service item.

All above three fields is optional, user can fill based on business requirement.

Other fast tab are related to the different type of functions like consolidation and additional reporting currency.

Comments