GST on Purchase of Services for overseas place of supply from Registered vendor

- akash shukla

- Mar 3, 2024

- 2 min read

Business Requirement

Service recipient has a GSTIN in Delhi and the Vendor also has a GSTIN for Delhi, but service provider and place of supply is outside India.

In this case, IGST will be charged as place of supply is outside India. So, invoice will be issued for INR 10,000 on which 18% IGST, has to be charged.

The supply of goods or services or both when the supplier is located in India and the place of supply is outside India shall be treated to be a supply of goods or services or both in the course of inter-state trade or commerce.

How to configure

As we understand, when both the service provider and recipient are from the same state code, GST is computed in two parts - CGST and SGST. However, if the place of supply is outside India, IGST will be calculated instead of CGST and SGST.

Follow below steps to configure this:

GST Rates

When forming combinations where the From State and Location State code are identical (as in our example with Delhi), ensure that the IGST column is appropriately filled with the relevant GST percentage (in our case, 18%). Additionally, mark Yes for the POS out of India column.

Create a purchase invoice

Choose the search icon, enter Purchase Invoice, and then choose the related link.

Select Vendor on Purchase Invoice header, GST vendor type should be Registered.

Select G/L Account on Purchase Invoice line. GST Group Code, HSN/SAC Code and GST Credit value should be selected as Availment if the tax input credit is available or else Non-Availment on the G/L Account.

GST Credit option can be changed on Purchase Invoice line.

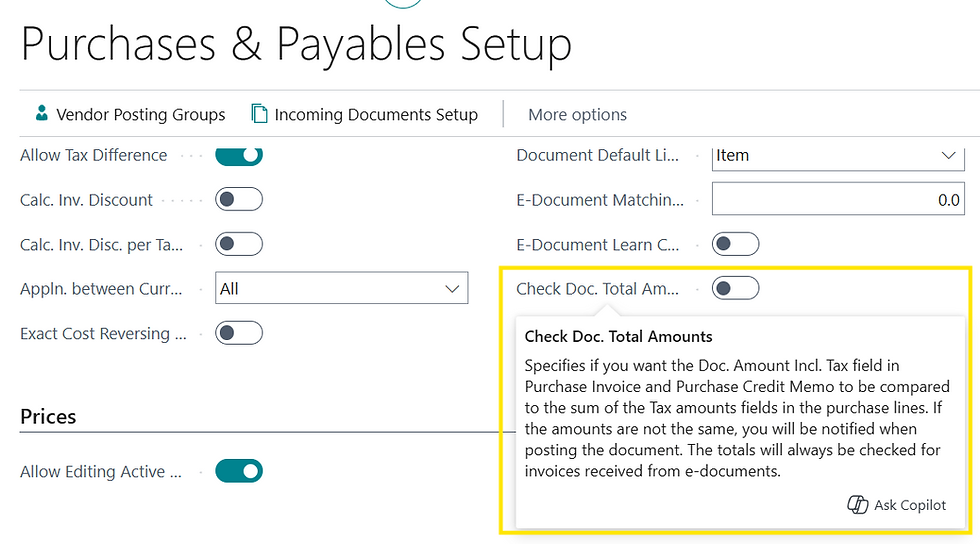

Please make sure turn ON below two Boolean under Tax information fast tab

GST calculation without enabling above two Boolean

GST calculation after enabling above two Boolean

GL Entries

GL Entries for purchase of services for overseas place of supply from registered vendor where input tax credit is available, will be as following:

Particulars | Amount |

Services Account | 10000 |

IGST Receivable Account | 1800 |

Vendor Account | -11800 |

GL Entries for purchase of services for overseas place of supply from registered vendor where input tax credit is not available, will be as following:

Particulars | Amount |

Services Account | 11800 |

Vendor Account | -11800 |

Comments